The IRR is the rate of return such that

The IRR is the discount rate that sets the NPV of the cash flows to zero.

IRR measures the average return of the investment:

- Simple way to communicate project value

- Only based on project cash flows (don’t need to make assumptions on )

IRR can also measure the sensitivity of the NPV to any estimation error in the cost of capital.

- In general, the difference between the cost of capital and the IRR is the maximum amount of estimation error in the cost of capital estimate that can exist without altering the original decision.

- If you are unsure of your cost of capital estimate, it is important to determine how sensitive your analysis is to errors in this estimation.

The weakness of IRR is that it implicitly assumes all cash flows generated by the project are reinvested at the project’s IRR rather than at the firm’s cost of capital until the project ends. So, for a project with high IRR, it may over-estimate the actual return from the project.

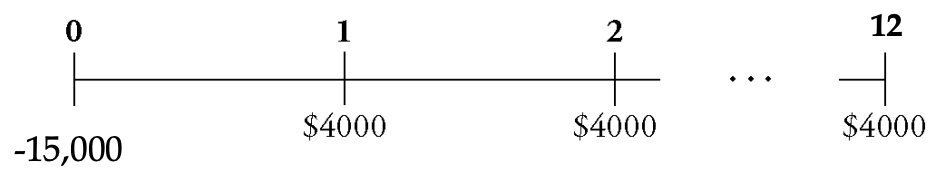

For example:

- Only if all payments of $4,000 can be reinvested to earn 24.8%, otherwise the actual return from the offer will not be 24.8%

IRR Rule

IRR Rule:

- Take any investment which

- Reject any investment which

IRR rule vs. NPV rule for stand alone projects:

- In general, , and vice versa.

- So IRR rule and NPV rule are generally consistent.

Weaknesses:

- Cannot be used for projects with non-conventional cash flows

- Delayed Investments (positive cash flows precede negative cash flows)

- Cannot be used for mutually-exclusive projects

- it is scale-independent

- affected by timing of cash flows