NPV is given as:

Consider a take-it-or-leave-it investment decision involving a single, stand-alone project:

- A fertilizer company can create a new environmentally friendly fertilizer at a large savings over the company’s existing fertilizer

- The fertilizer will require a new factory that can be built at a cost of 28 million after the first year, and will last for four years.

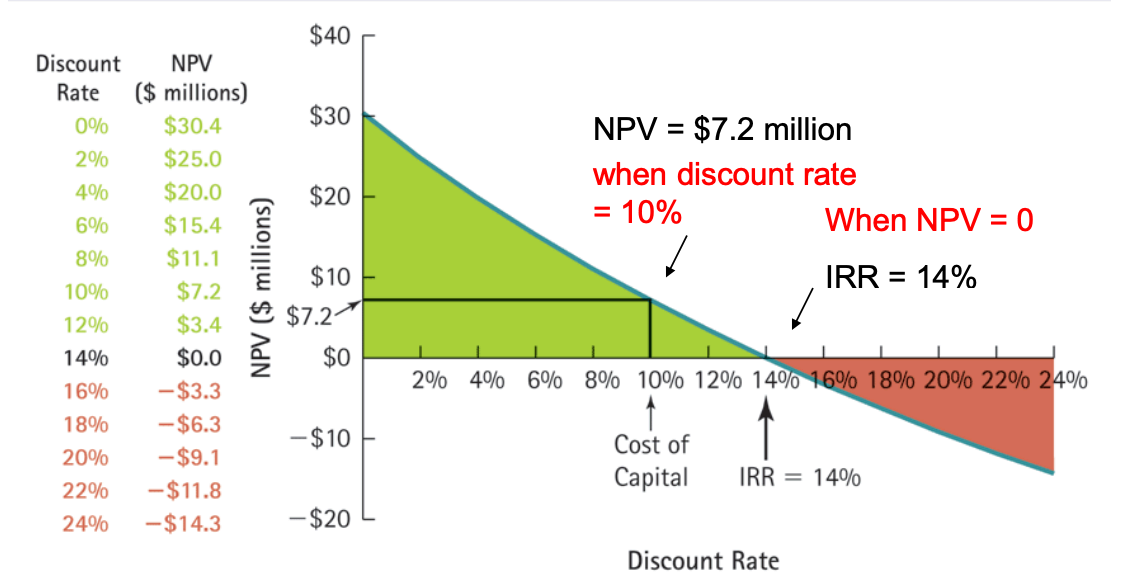

The financial managers responsible for this project estimate a cost of capital of 10% per year, so we use to get NPV of 7.2 million.

Interpretation of positive NPV:

- Recovery of capital: If we invest in the project, we will be able to recover the cost of the project

- Return on capital: The project will provide a 10% return to the investors on their invested capital.

- Value created for investors: The NPV of $7.2 million is the additional value that is created for the investors, on top of the 10% return.

NPV Decision Rule

For stand alone projects:

- Accept positive NPV projects because accepting them is equivalent to receiving cash today in an amount equivalent to their NPV.

- Reject negative NPV projects because accepting them would reduce the wealth of investors.

- Accept zero-NPV projects because you will earn the required rate of return for the projects. In an efficient market, you will not earn abnormal profit. But accepting the project does not reduce value either.

To choose among alternatives:

- Take the alternative with the highest NPV because it maximizes the value of the firm

NPV Profile

The NPV of the project depends on its appropriate discount rate/cost of capital. Often, there may be some uncertainty regarding the project’s cost of capital. In that case, it is helpful to compute an NPV profile, which graphs the project’s NPV over a range of discount rates.