A zero-coupon bond makes no coupon payments, only making a single cash flow at the end. It always sells at a discount (price lower than face value), so they are called pure discount bonds.

- Treasury bills are U.S. government zero-coupon bonds with a maturity of up to one year.

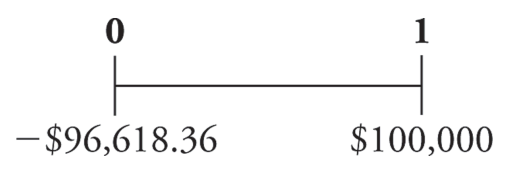

Suppose that a one-year, risk-free, zero-coupon bond with a 96,618.36. The cash flows would be:

The rate of return on the bond would be:

The Yield to Maturity (YTM) on the bond is the discount rate that sets the present value of the promised payment from the bond equal to the current market price of the bond.

- Intuitively, the yield to maturity for a zero-coupon bond is the return you will earn as an investor by buying the bond at its current market price, holding the bond to maturity, and receiving the promised face value payment.

In general, the yield to maturity of an -year zero-coupon bond can be found by:

- The per-period rate of return for holding the bond from today till maturity on date

- Solving for the YTM of a zero-coupon bond is the same process we used to solve for the internal rate of return – YTM is the IRR of buying the bond.

The price of a zero-coupon bond:

Risk-Free Interest Rates

In a competitive market, all risk-free investments must earn the same rate of return over the same period. A default-free (risk free) zero-coupon that matures on date provides a risk-free return over this period.

Thus, the Law of One Price guarantees that the risk-free interest rate equals the yield to maturity on such a bond. That is, the YTM of a risk free bond is a proxy for risk free rate.

“Spot interest rate” is another term for a default-free, zero-coupon yield “on the spot”.

Yield Curve

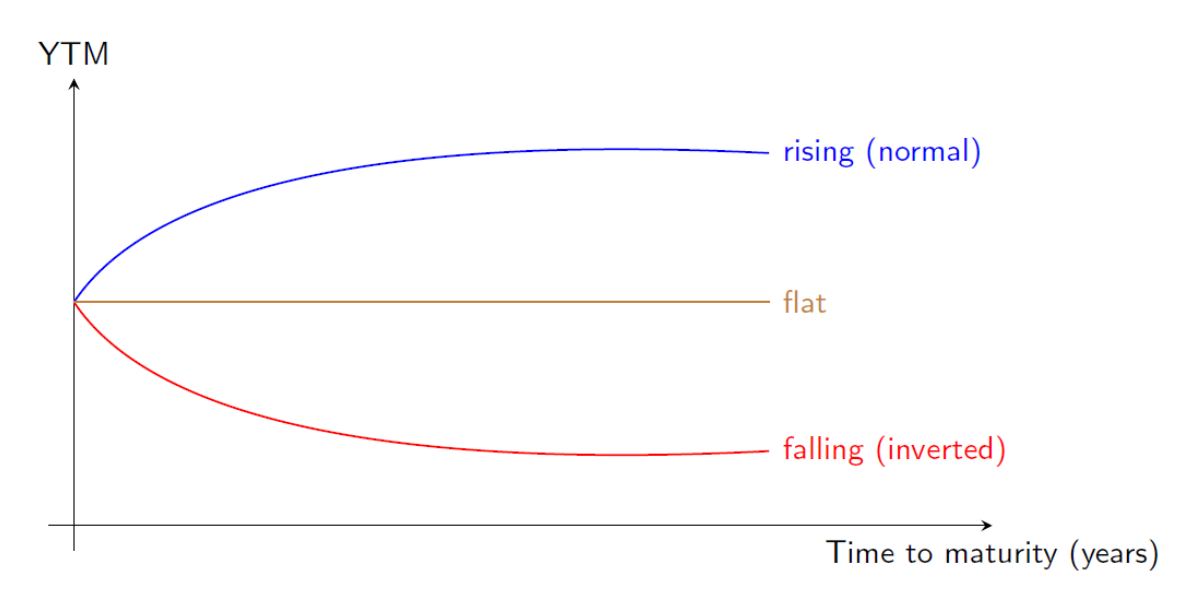

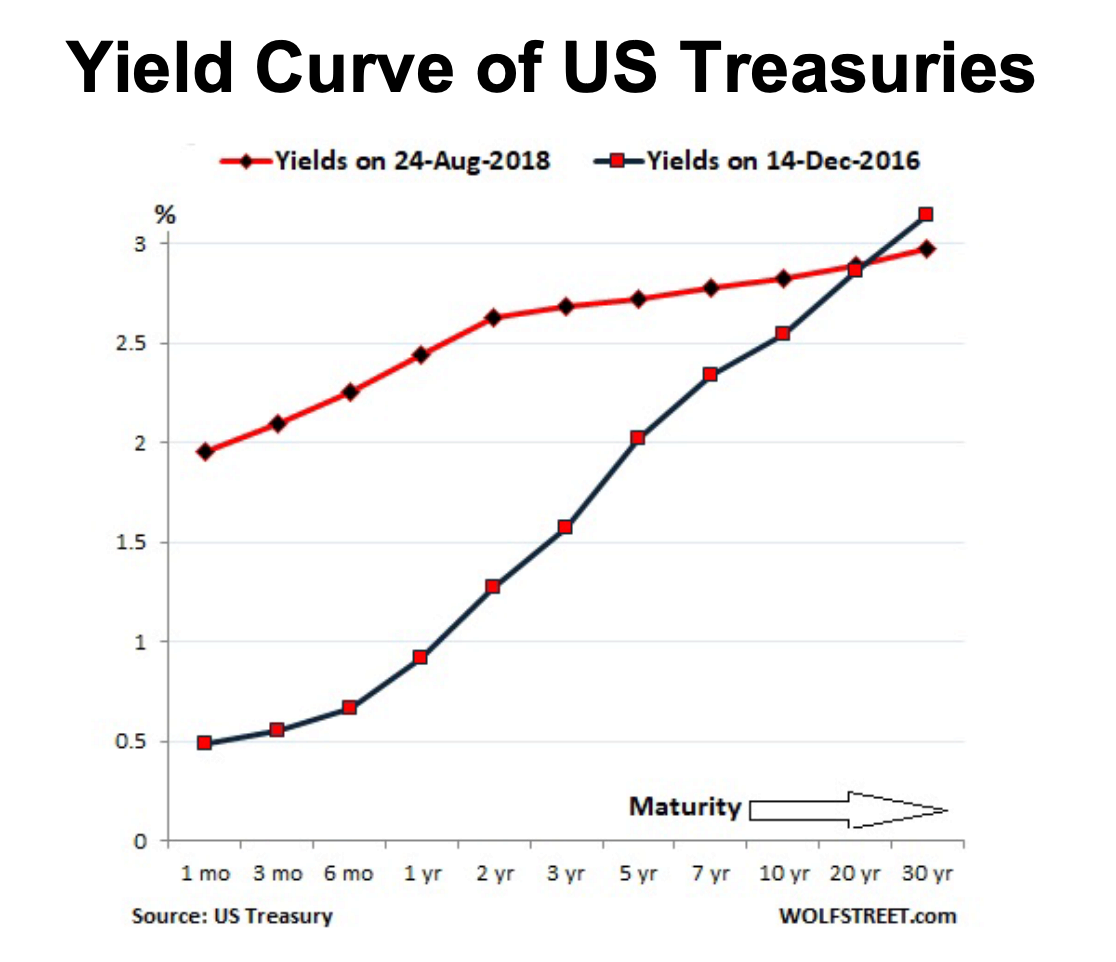

The yield curve is a plot of the yield of risk-free zero-coupon bonds as a function of the bond’s maturity date.

If the yield curve is downward sloping, longer maturity bonds generally have lower yields than shorter maturity bonds.