How do we choose between one project among several possible projects when the choice is mutually exclusive?

Identical Scale

If the projects are of identical scale, the NPV and IRR rules should be consistent and can be used.

Different Scale

The IRR is a measure of the average return, but NPV is a measure of the total dollar impact on value.

- When a project’s size is doubled, its NPV will double.

- This is not the case with IRR.

Here, NPV rule is the best decision rule because it is consistent with the objective of wealth maximization. The IRR rule cannot be used to compare projects of different scales.

Note: To use IRR rule for projects of different investment size, compute the IRR of incremental cash flows (larger project’s minus smaller project’s) to decide if it’s worthwhile to make extra investment.

Crossover Point

- The crossover point is the discount rate that makes the NPV of the two investments equal. The difference of the two NPVs is the incremental impact of choosing one project over another.

The crossover point is the discount rate at which one would be indifferent between the two investment opportunities because the incremental value of choosing one over the other would be zero.

Decision Rules (same as IRR rule):

- If crossover point > cost of capital, then you should choose the larger scale (more expensive) project, i.e., making additional investment has an IRR > r

- If the crossover point < cost of capital, then you should choose the alternative, i.e., smaller scale project

Different Cash Flow Timing

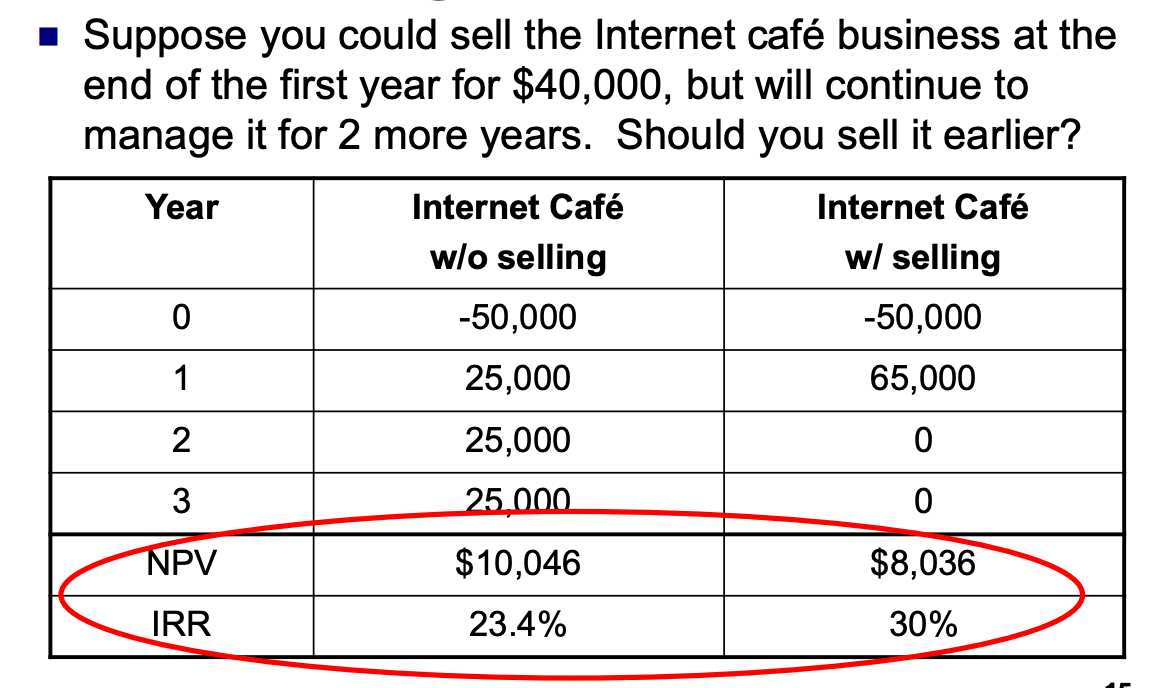

Suppose you could sell your Internet café business at the end of the first year for $40,000, but will continue to manage it for 2 more years. Should you sell it earlier?

While the IRR from selling the business is higher, it is earned only in the first year. 30% over three years is misleading.

- IRR from keeping the business is lower but it can be earned for 3 years. NPV of keeping the business is larger.

- IRR is sensitive to timing of cash flows.

- It is possible to alter the ranking of projects based on IRR without changing their ranking in terms of NPV.

- Picking the investment opportunity with the largest IRR can lead to a mistake. Always rely on NPV in choosing mutually exclusive projects.