Standalone Projects:

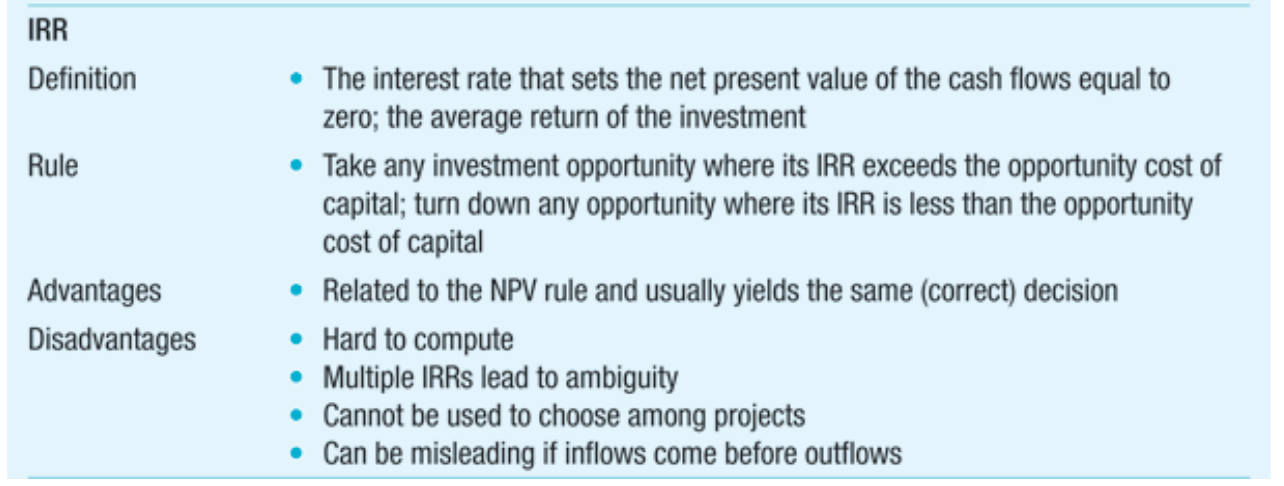

For projects with conventional cash flows: NPV rule and IRR rule are consistent. For projects with non-conventional cash flows:

- Delayed investment (positive cash flows precede negative cash flows)

- Use NPV rule

- IRR rule is unreliable.

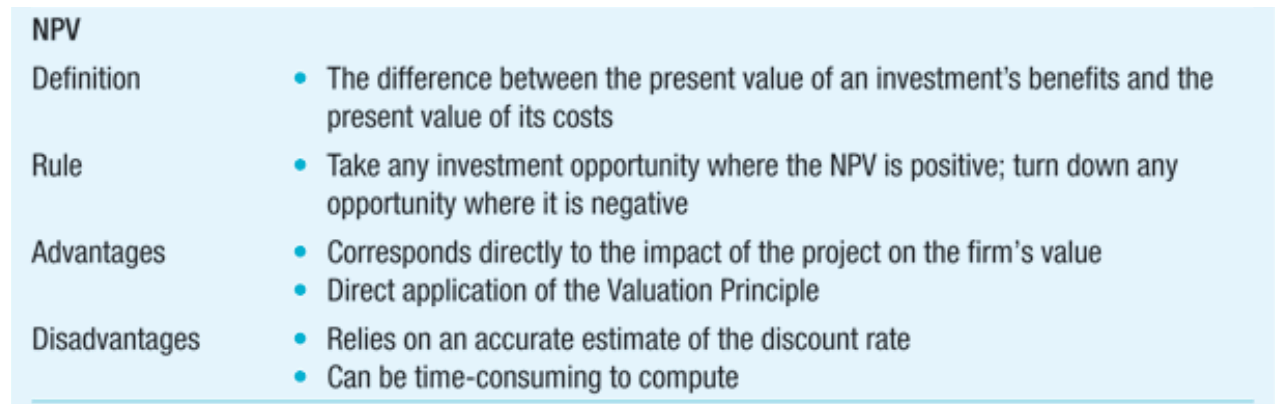

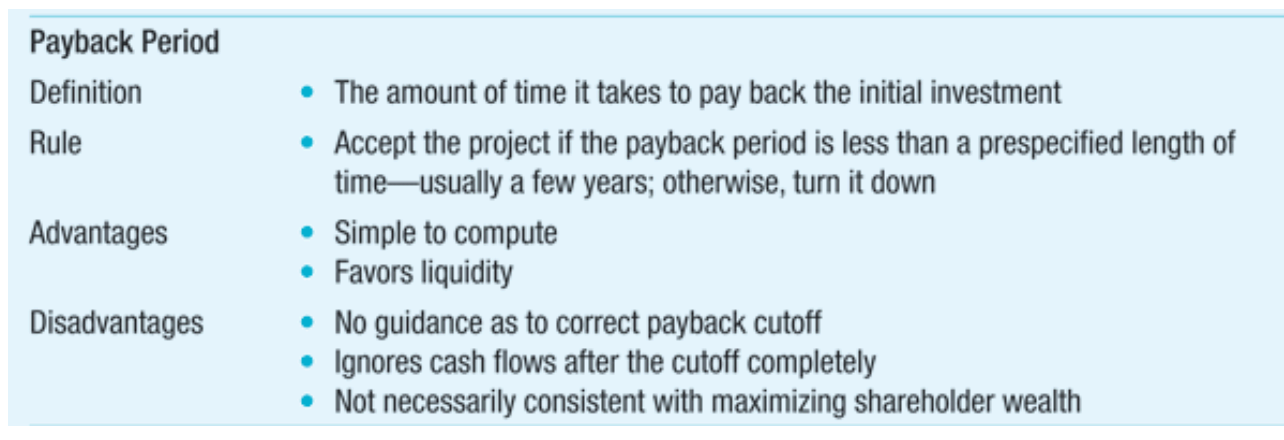

Alternative Decision rule: Payback Rule

Mutually Exclusive Projects

For projects with different scales and different timing of cash flows:

- Use NPV rule

- IRR rule is subject to limitations in comparison

- Adjustments to use IRR rule

- Compute Crossover point (incremental IRR)

- Then use IRR rule based on Incremental IRR

- Adjustments to use IRR rule

For projects with different lives:

- Compute Equivalent annual annuity (EAA)