Suppose that a project will offer you a lump sum of 500,000 per year at the end of the next three years. Your estimated cost of capital is 10%.

The NPV is:

The IRR for this investment is 23.28%.

In this case, we have:

- Negative NPV. By the NPV rule, we should reject this project

- IRR > r. By the IRR rule, we should accept this project

When cash inflow occurs before cash outflows, the interest rate becomes a financing (borrowing) cost rather than the rate of return. So decision rule should be reversed.

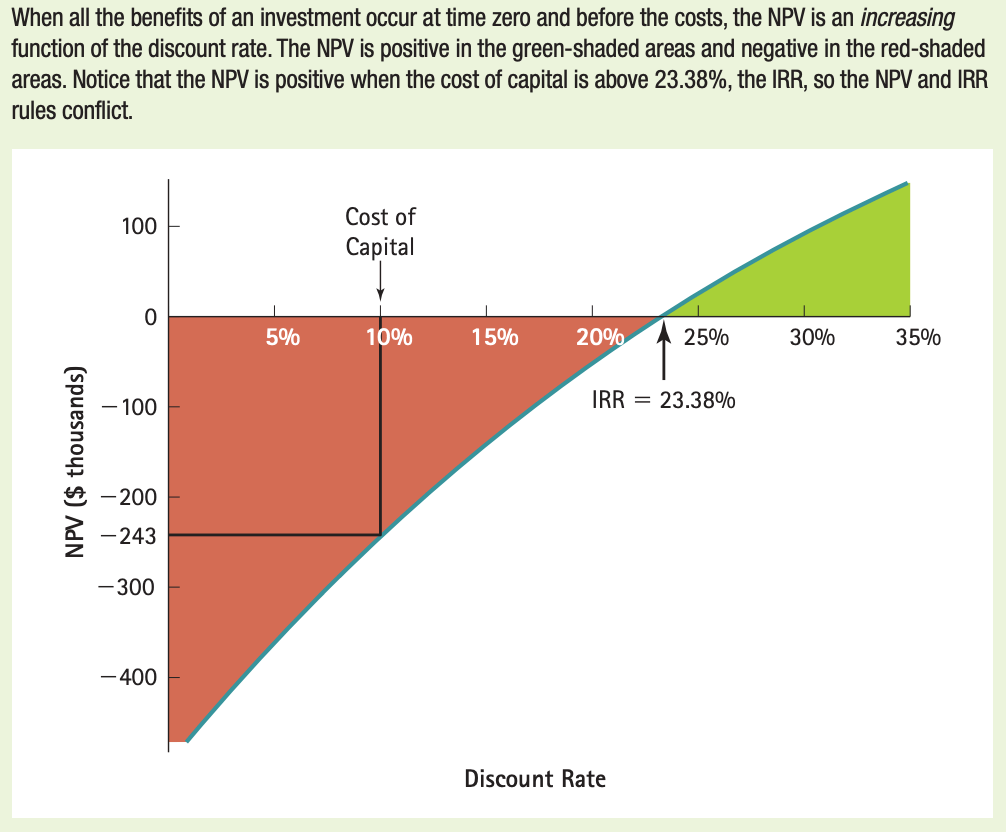

To resolve the conflict we can look at the NPV profile:

When the benefits of an investment occur before the costs, the NPV is an increasing function of the discount rate. So the IRR rule does not apply anymore (opposite interpretation).