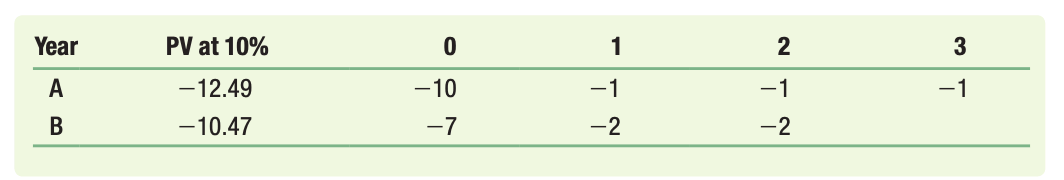

Often, a company will need to choose between two solutions to the same problem. A complication arises when those solutions last for different periods of time. For example, a firm could be considering two vendors for its internal network servers. Each vendor offers the same level of service, but they use different equipment.

- Benefits are the same. The objective is to minimize the cost.

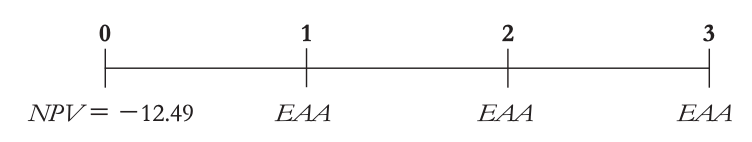

We put the choices in an equal footing: computing their constant annual cost that is the same as the PV of one lump sum at time zero.

Computing an Equivalent Annual Annuity (Equivalent Annual Cost EAC) by:

- Computing its PV at the cost of capital.

- Computing the equivalent -year annuity with the same PV as the cash flows of the project.

The formula for this is:

This is just the cash flow formula for an annuity.