Profit vs. Cash Flow

- Cash is important because it is needed to pay bills and maintain operations and is the source of any return of investment for investors.

- Net income Cash earned

- The net income typically does NOT equal the amount of cash the firm has earned.

- A firm may be profitable as measured by net income but is short of cash.

Accounting Income vs. Cash Flow

Book profits:

- Calculated using accrual basis: Based on matching principle (recognizes revenue when it is earned and matches expenses to the same period, even if the actual cash has not been exchanged)

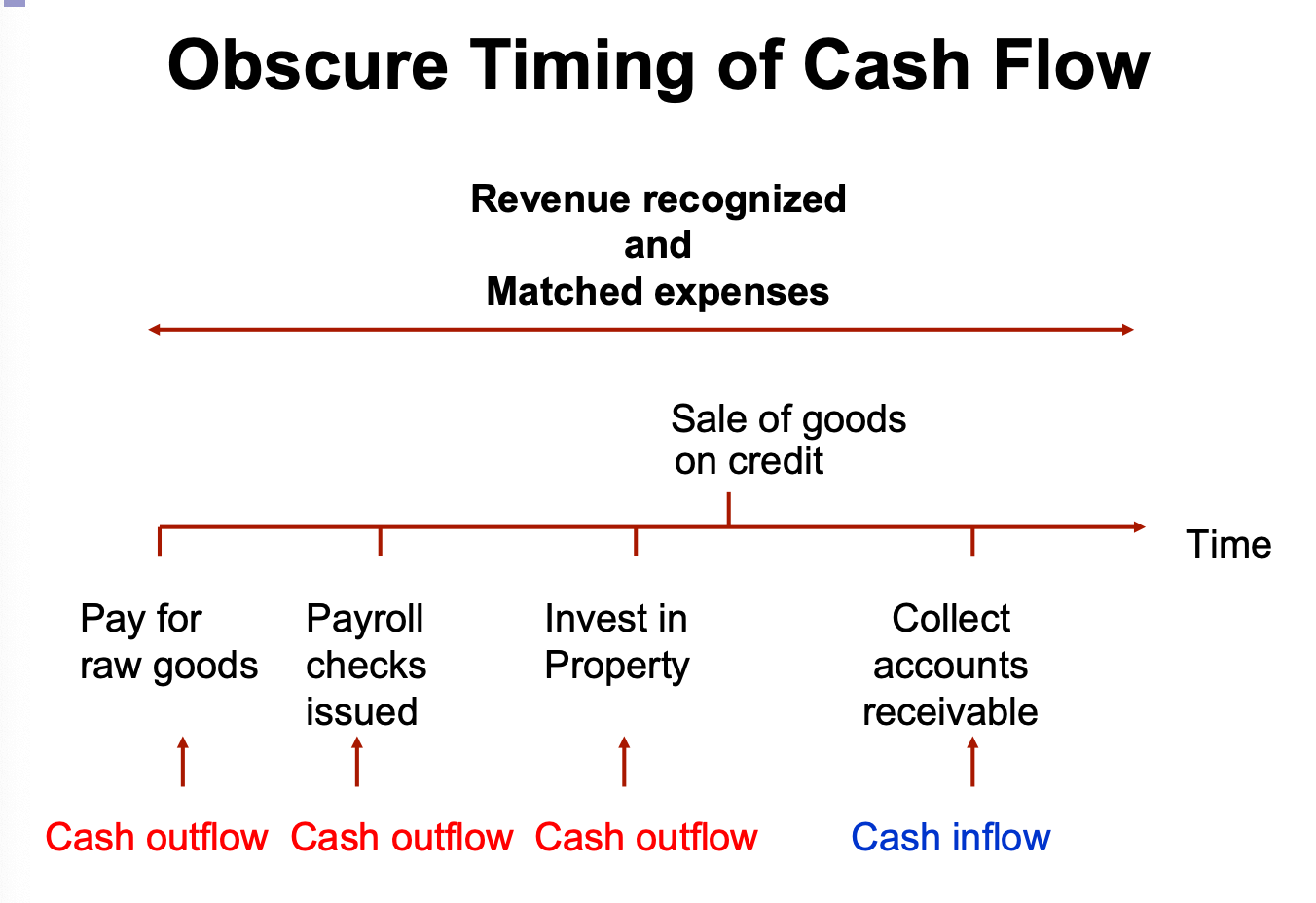

- This can obscure the timing of cash flow because revenue and expenses may be recorded without corresponding cash transactions.

- Non-cash items (depreciation and amortization)

- Depreciation: a yearly deduction to recognize the reduction in the value of buildings and equipment and they wear out over time

- Amortization: annual charge to recognize the decline of value of these intangibles over time

- Uses of cash not included

- Investment in Property, Plant, and Equipment

- Companies may pay for raw goods, issue payroll checks, or invest in property before earning any revenue.

- These payments are actual cash outflows, but under accrual accounting, they may not immediately be reflected as expenses.

- Goods may be sold on credit, meaning the company recognizes revenue without receiving cash. The revenue is recorded in the income statement, but the cash inflow will only occur when the customer pays.

- Eventually, the company collects the payment from the customer, resulting in a cash inflow.

Impact of Depreciation on Cash Flow

- Acquisition of assets as capital expenditures do not affect earnings (net income) directly. Instead, the depreciation of $1 million would appear as an operating expense on the income statement.

- Depreciation is an operating expense, so the firm’s operating income, EBIT, and pretax income would be affected.

What is the effect of the additional depreciation on cash flows? Depreciation is not an actual cash outflow, even though it is treated as an expense, i.e., cash flow of the firm will not decrease because of additional depreciation. So, the only effect on cash flow is through the reduction in taxes.

Basically, depreciation reduces net income on the income statement because it’s treated as an expense