| Symbol | Term |

|---|---|

| Interest rate | |

| Present value | |

| Future value | |

| Cash flow | |

| Number of periods | |

Time Value of Money

Future value of a cash flow:

Present value of a cash flow:

Interest Rate vs. Discount Rate vs. Cost of Capital

- “Interest rate” is used to mean a quoted rate in the market.

- “Discount rate” is the appropriate rate for discounting a given cash flow, matched to the frequency of the cash flow.

- “Cost of capital” to indicate the rate of return on an investment of similar risk.

Chapter 6 - Bonds

Bond Calculation Questions

- Use coupon rate to calculate PMT:

- Make sure to multiply by number of payments per year

- I/Y is yield to maturity divided by number of payments per year

- FV is par value

- PV is price paid

Premium/Par/Discount

- Premium/Above par: Bond price > Face Value, or Coupon rate > YTM

- At par: Bond value = Face Value, or Coupon Rate = YTM

- Discount/Below par: Bond price < Face Value, or Coupon Rate < YTM

Sensitivity

Longer maturity = sensitive Low coupon = sensitive

- Why is low/no coupon sensitive? A larger portion of the cash flows to be received in the future will result in larger changes due to compounding

Market rate rises → Price falls → YTM rises to match market Market rate falls → Price rises → YTM falls to match market

Credit Spread

Credit spread = Bond yield - treasury yield

Chapter 7 - Stock

- Reinvsting earnings:

Chapter 9 - Capital Budgeting

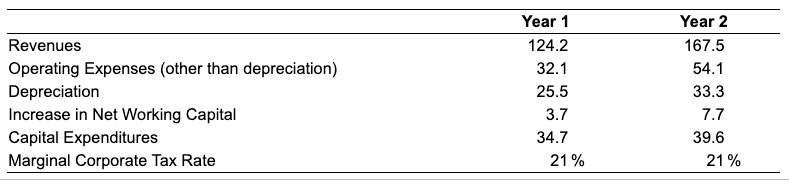

- Free cash flows = Earnings + Depreciation - Capital Expenditures - Change in NWC

- Earnings here is incremental earnings or unlevered net income

- Net working capital (NWC) = Current Assets - Current Liabilities

Incremental earnings approach:

Tax shield approach:

After-tax cash flow from asset sale:

where capital gain/loss is sale price - salvage value.

- Savage value = purchase price - accumulated depreciation

Chapter 12 Systematic Risk

Beta

-

Beta () is the is the expected percentage change in the return of a security for a 1% change in the market’s return. -Beta for HP = 1.4, Market excess return was -2.5 → HP excess return was

-

Excess return = Return - Market portfolio return

SML

- -intercept = risk-free rate

- = market risk premium

- above SML → underpriced (we should buy)

- below SML → overpriced (we should sell)