Corporate Bond Yields

Corporate bonds are issued by corporations.

These bonds will often come with credit risk, which is the risk of default.

- Investors pay less for bonds with credit risk than they would for an otherwise identical default-free bond (T-bonds).

- The yield of bonds with credit will be higher than that of otherwise identical default-free bonds. The coupon rate is determined by the rate

- The coupon rate is determined by the risk characteristics of the bond when issued.

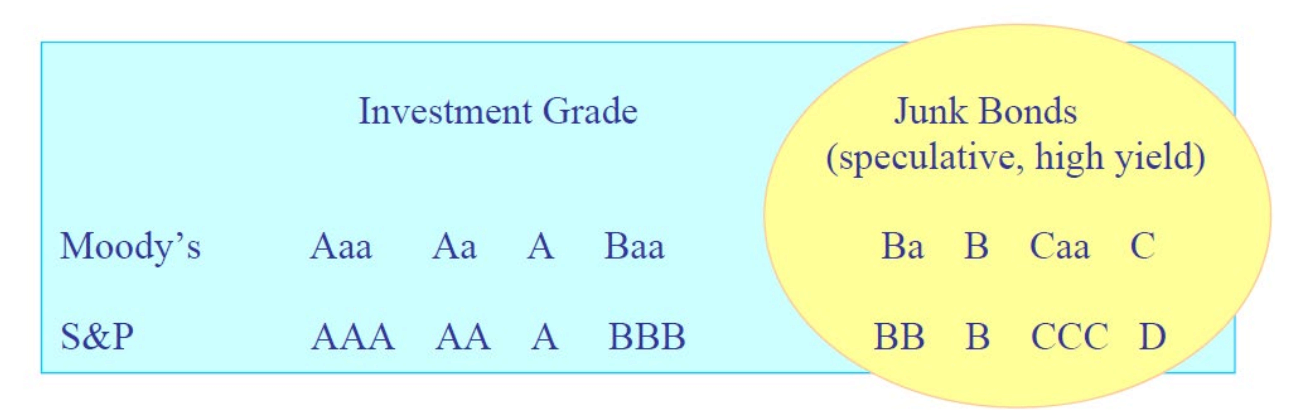

Bond Ratings

Bond ratings are issued by rating companies to reflect the credit quality of issuers. The rating reflects the issuer’s financial ability to make interest payments and repay the loan in full at maturity.

Typically, high rating bonds will have lower yields and vise versa.

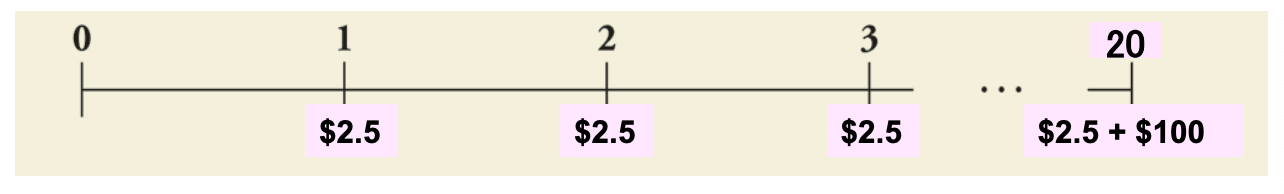

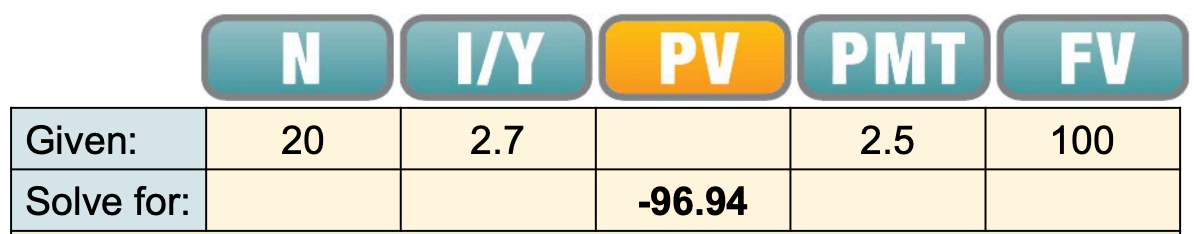

Example: Your firm has a credit rating of A. You notice that the credit spread for 10-year maturity debt is 90 basis points (0.90%). Your firm’s 10-year debt has a coupon rate of 5%. You see that new 10-year Treasury notes are being issued at par with a coupon rate of 4.5%. What should the price of your outstanding 10-year bonds be?

Your bonds offer a higher coupon (5% vs. 4.5%), but sell for a lower price (100) than treasuries of the same maturity. The main reason is credit spread; your firm’s higher probability of default leads investors to demand a higher YTM on your debt. If you bonds paid 5.4% coupons, it would sell at $100/