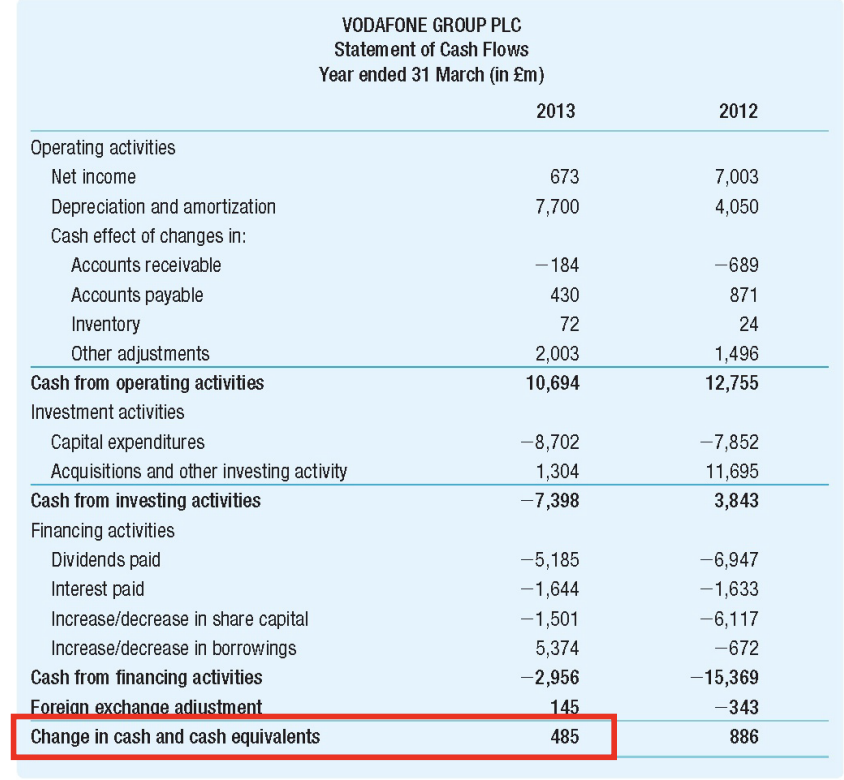

The Statement of Cash Flows reports the cash that flowed into and from a firm during a time period. Information from the income statement and balance sheet are used to determine:

- How much cash the firm has generated

- How that cash has been allocated during a set period

Amount reported in “Change in Cash” on will be equal to the difference between beginning “cash” and ending “cash” balances on the balance sheet. In other words, cash flow that do not go to shareholders (dividends and decrease in capital) or creditors (interest and loan repayment) end up as company cash.

Cash from operating activities

- Changes in working capital

- deduct the increases in accounts receivable

- add increases in accounts payable

- deduct increases to inventory

- Add depreciation to net income

- Adjust net income by all non-cash items related to operating activities

Accounts Receivable

Accounts receivable are goods and services that we have provided to customers, but for which we haven’t been paid yet.

An increase in AR means:

- Increase in cash that we need to collect from customers

- Decrease in cash that customers paid us in this period

- Therefore, decrease in cash flow.

A decrease in AR means:

- An increase in cash that customers paid us in this period

- A decrease in cash that we need to collect from customers.

- Therefore, increase in cash flow.

Accounts Payable

Accounts payable are goods and services that we received from suppliers, but for which we haven’t paid yet.

An increase in AP means:

- A increase in cash that we need to pay suppliers

- An decrease in cash that we paid to suppliers this period

- Therefore, increase in cash flow.

A decrease in AP means:

- A decrease in cash that we need to pay suppliers

- An increase in cash that we paid to suppliers this period

- Therefore, decrease in cash flow.

Inventory

Inventory: Unsold finished goods and intermediate goods that were not used for production. For example, in the case of Apple, unsold iPhones (finished goods), yet-to-be-assembled iPhone screens (intermediate goods).

An increase in inventory means:

- An increase in either i) stock of goods we did not sell or ii) higher purchases from intermediate goods suppliers, or both

- Decrease in cash flow

A decrease in inventory means:

- An decrease in either i) stock of goods we did not sell or ii) lower purchases from intermediate goods suppliers, or both

- An increase in cash coming from either i) higher sales of finished goords or ii) lower purchases from intermediate goods suppliers, or both

- Increase in cash flow

Net working capital

- Net working capital = Accounts receivable + Inventory - Accounts payable

- This is the share of assets and liabilities that comes from the firm running its core operating activities

- When NWC increases, cash flow decreases

- Because of higher inventory, higher accounts receivable, or lower accounts payable

- When NWC decreases, cash flow decreases

- Because of lower inventory, lower accounts receivable, or higher accounts payable

Cash from investment activities:

- Subtract actual capital expenditure

- Deduct other assets purchased or investments

Investment entails a cash outlow:

- Capital expenditures decrease cash flows (we are paying cash for fixed assets like machinery, plants, etc)

- Acquisitions also decrease cash flows (we are paying cash to buy another firm)

- Selling fixed assets increases cash flows

Cash from financing activities:

-

Subtract dividends paid

-

Add cash from sale of stock / deduct cash spent repurchasing own stock

-

Changes to short-term and long-term borrowing (new borrowing, repayment of debt)

-

An increase in dividends and interest payments decreases cash flows (paying more to shareholders and lenders).

-

An increase in equity capital and debt (taking a loan from a bank) increases cash flows to the firm (receiving cash from shareholders/lenders).

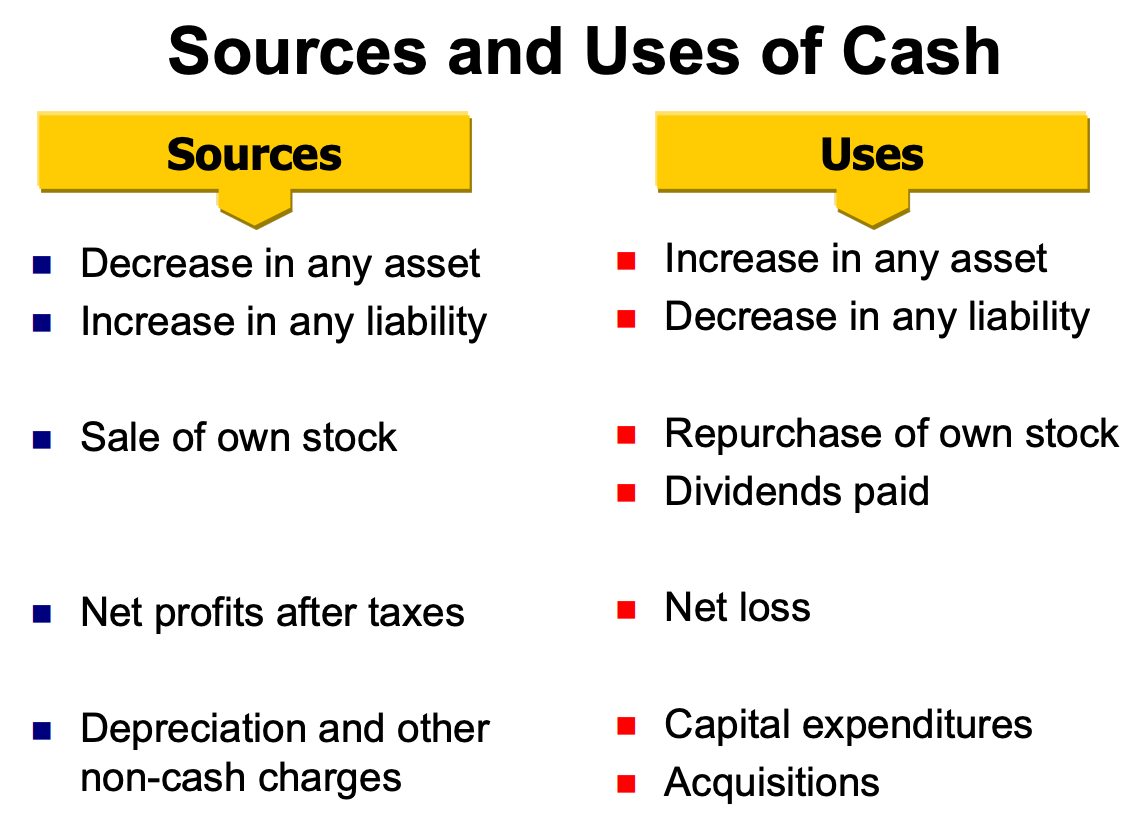

Sources and Uses of Cash