Problem:

Background:

- Suppose that the managers of the router division of Cisco Systems are considering the development of a wireless home networking appliance, called HomeNet, that will provide both the hardware and the software necessary to run an entire home from any Internet connection.

- In addition to connecting computers and smartphones, HomeNet will control Internet-capable televisions, streaming video services, heating and air conditioning units, major appliances, security systems, office equipment, and so on. The major competitor for HomeNet is a product being developed by Brandt-Quigley Corporation

Incremental earnings part:

- Cisco has completed a $300,000 feasibility study to assess its attractiveness.

- Based on extensive marketing surveys, the sales forecast for HomeNet is 50,000 units per year. Given the pace of technological change, Cisco expects the product will have a four-year life with an expected retail (B2C) price of 260. Actual production will be outsourced at a cost (including packaging) of $110 per unit.

- To verify the compatibility of new consumer Internet-ready appliances, as they become available, with the HomeNet system, Cisco must also establish a new lab for testing purposes. It will rent lab space but will need to purchase $7.5 million of new equipment. The equipment will be depreciated using the straight-line method over a five-year life. Cisco’s marginal tax rate is 40%.

- The lab will be operational at the end of one year. At that time. HomeNet will be required to ship. Cisco expects to spend $2.8 million per year on rental costs for the lab space, as well as marketing and support for this product.

Incremental free cash flow part:

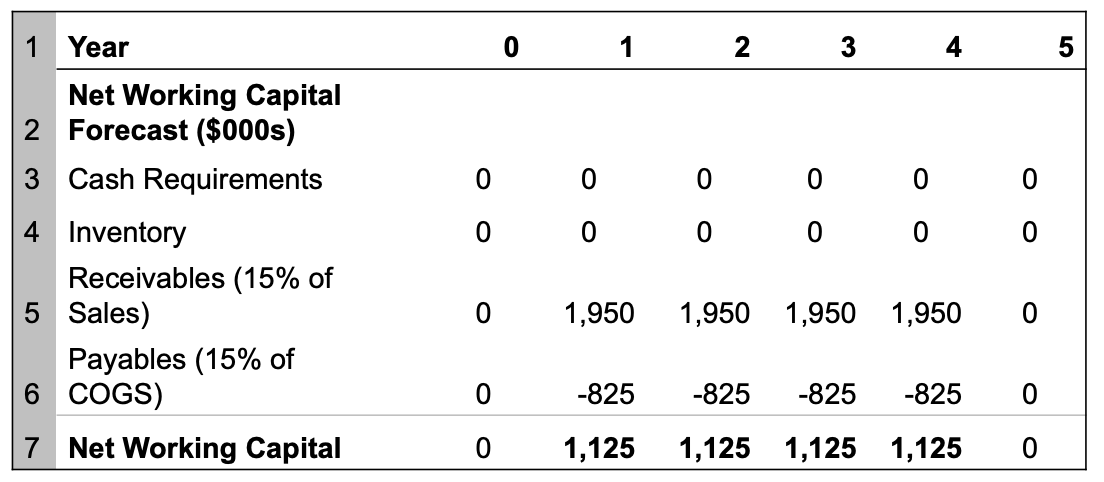

- Suppose that HomeNet will have no incremental cash or inventory requirements (products will be shipped directly from the contract manufacturer to customers).

- However, receivables related to HomeNet are expected to account for 15% of annual sales, and payables are expected to be 15% of the annual cost of goods sold (COGS).

- 15% of 1.95 million and 15% of 825,000.

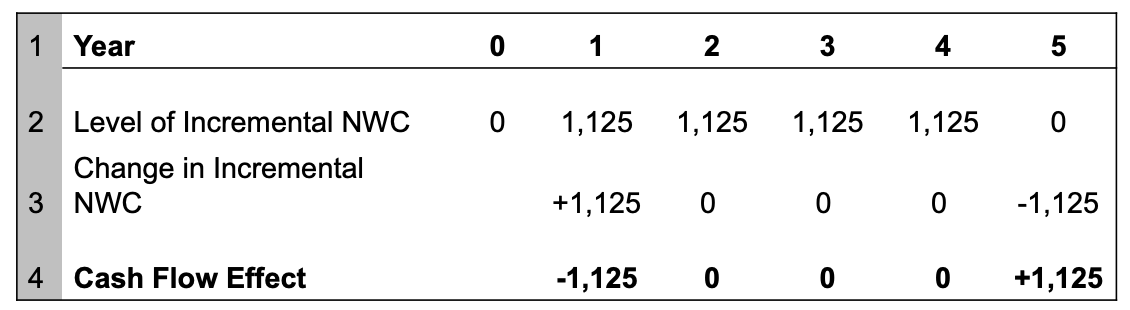

- HomeNet’s net working capital requirements are shown in the following table

After-tax salvage value part:

- Suppose that the 800,000 when the production discontinues and the lab is shut down in year 4. So the machine won’t be kept till year 5. What adjustments must we make to HomeNet’s free cash flow?

Solution

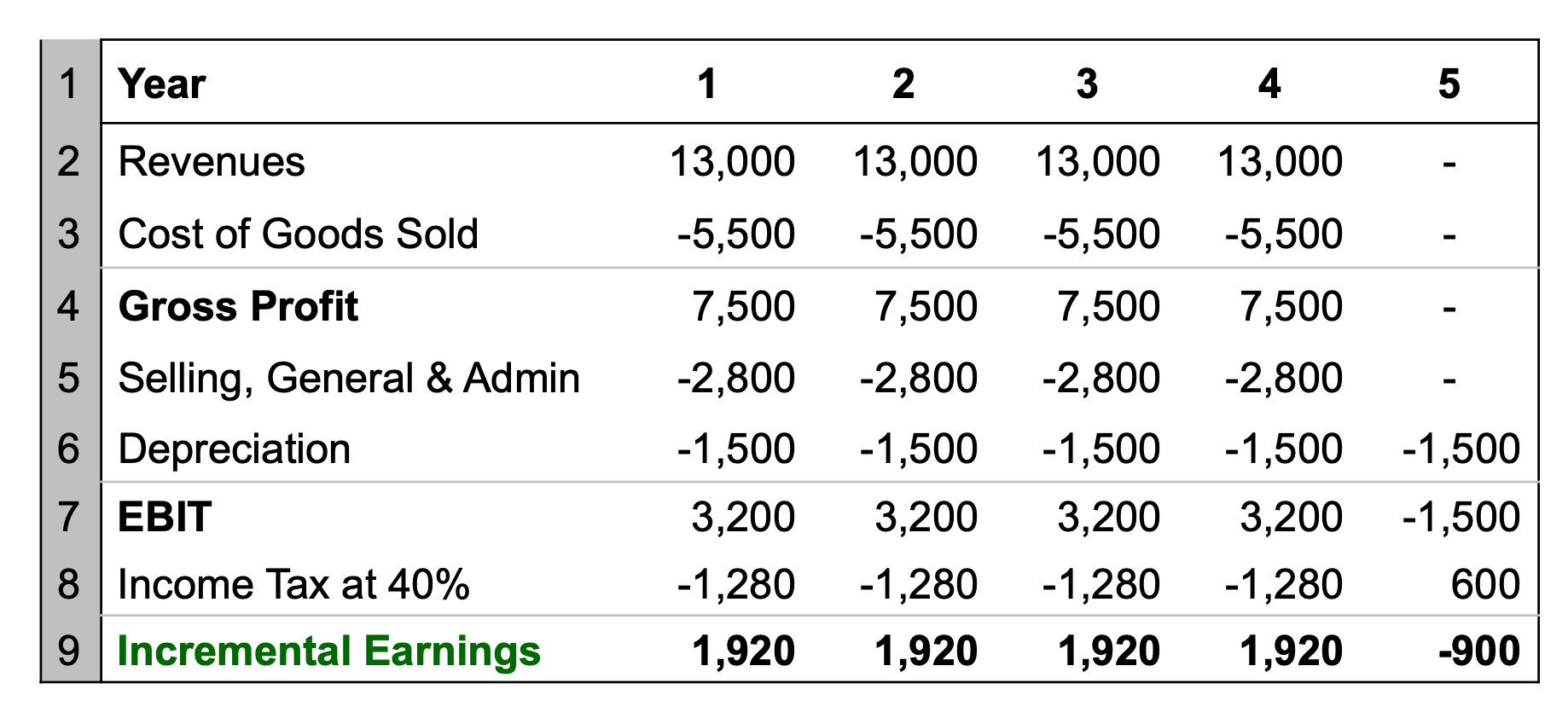

Incremental Earnings

In this part, we forecast the incremental earnings from the HomeNet project.

In general, we want to solve

Let’s find each of the quantities in the formula.

Incremental revenue: Sales of 50,000 units/year, per unit price = $260

50,000\times $260 = $13,000,000Incremental cost estimates:

- Per unit production cost = $110

- Up-front new testing equipment = $7.5 million

- Annual depreciation = 1.5 million

- Note that the project lasts for 4 years but the equipment has a 5-year life. So there is a final depreciation charge in the 5th year.

- Annual operating cost = $2.8 million

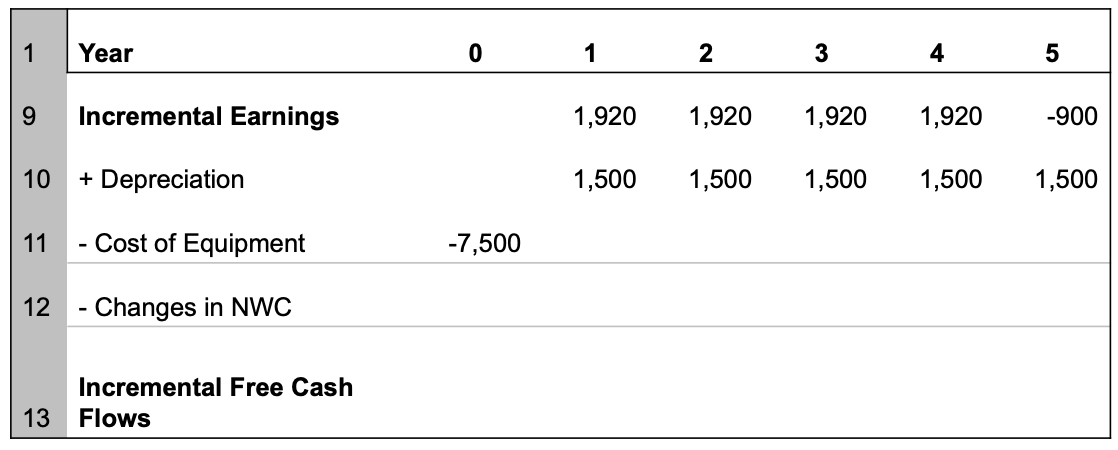

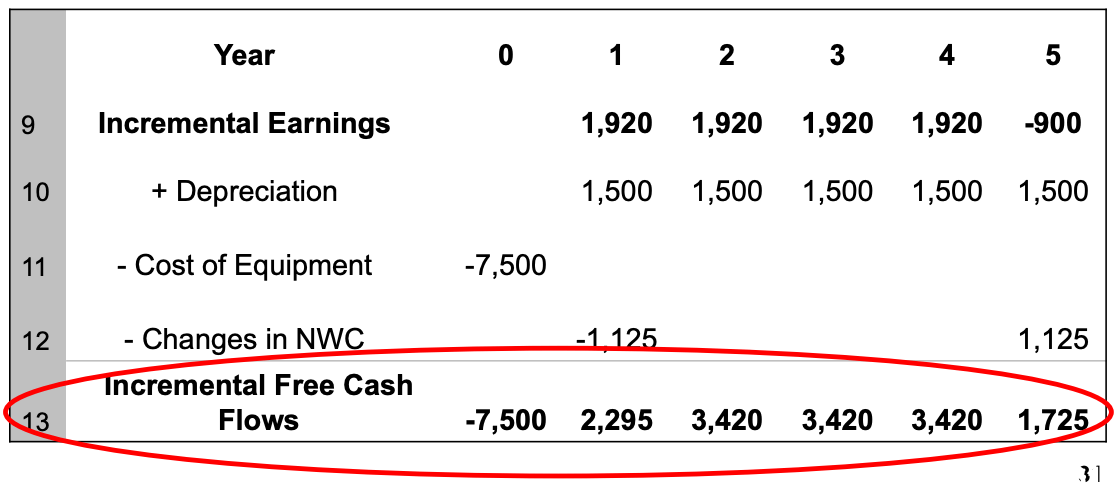

Incremental Free Cash Flows

In this part, we compute the incremental free cash flows for HomeNet to decide whether Linksys should proceed with the project.

We recognize that:

- There is a 7.5 million cash outflow associated with the purchase in year 0

- We need to add back the 1.5 million depreciation expenses from year 1 to 5 as they are not actually cash outflows

Let’s account for NWC now. Looking at the NWC requirement table in the problem section, we see that:

- In year 1, NWC increases by $1.125 million. Any increases in NWC represent an investment that reduces the cash available to the firm.

- In years 2-4, NWC does not change, so no further contributions are needed.

- In year 5, when the project is shut down, NWC decreases by $1.125 million as the payments of last customers are received and the final bills are paid.

Note that cash flow effect from changes in NWC is always opposite in sign to the change of NWC. So, in capital budgeting, we subtract changes in NWC from earnings to estimate incremental cash flows.

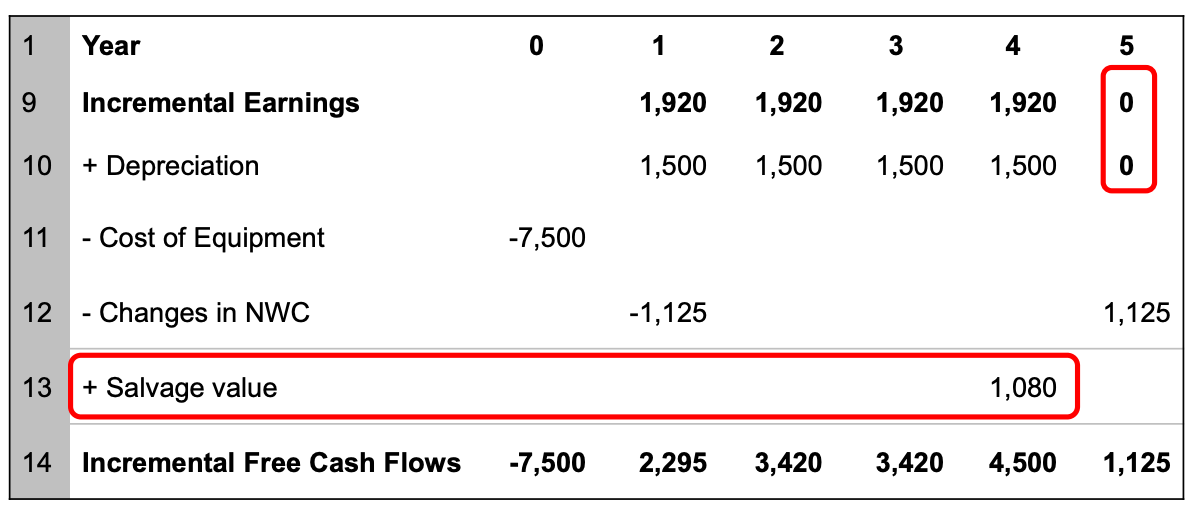

Then, the final solution for incremental free cash flows is:

We can use this to calculate the NPV:

HomeNet’s NPV is thus $2862 million dollars.

After-Tax Salvage

Suppose that the 800,000 when the production discontinues and the lab is shut down in year 4. So the machine won’t be kept till year 5. What adjustments must we make to HomeNet’s free cash flow?

We want to:

- Compute accumulated depreciation and determine the book value of equipment at end of year 4.

- Compute difference between sale price and book value.

- Compute tax credit/due on capital loss/gain and subtract it from the sale price.

- Remove the depreciation expense in year 5

We have:

- BV = 1.5 million in year 4

- BV > SV → Capital loss → Tax credit

- Capital loss = 800,000 = $700,000

- Tax credit = 0.4 × 280,000

- After-tax cash flow from selling the equipment: = 280,000 = $1,080,000

As sale price is lower than book value, there will be a capital loss which leads to tax credit. $1,080,000 will need to be added to HomeNet’s free cash flow in year 4.