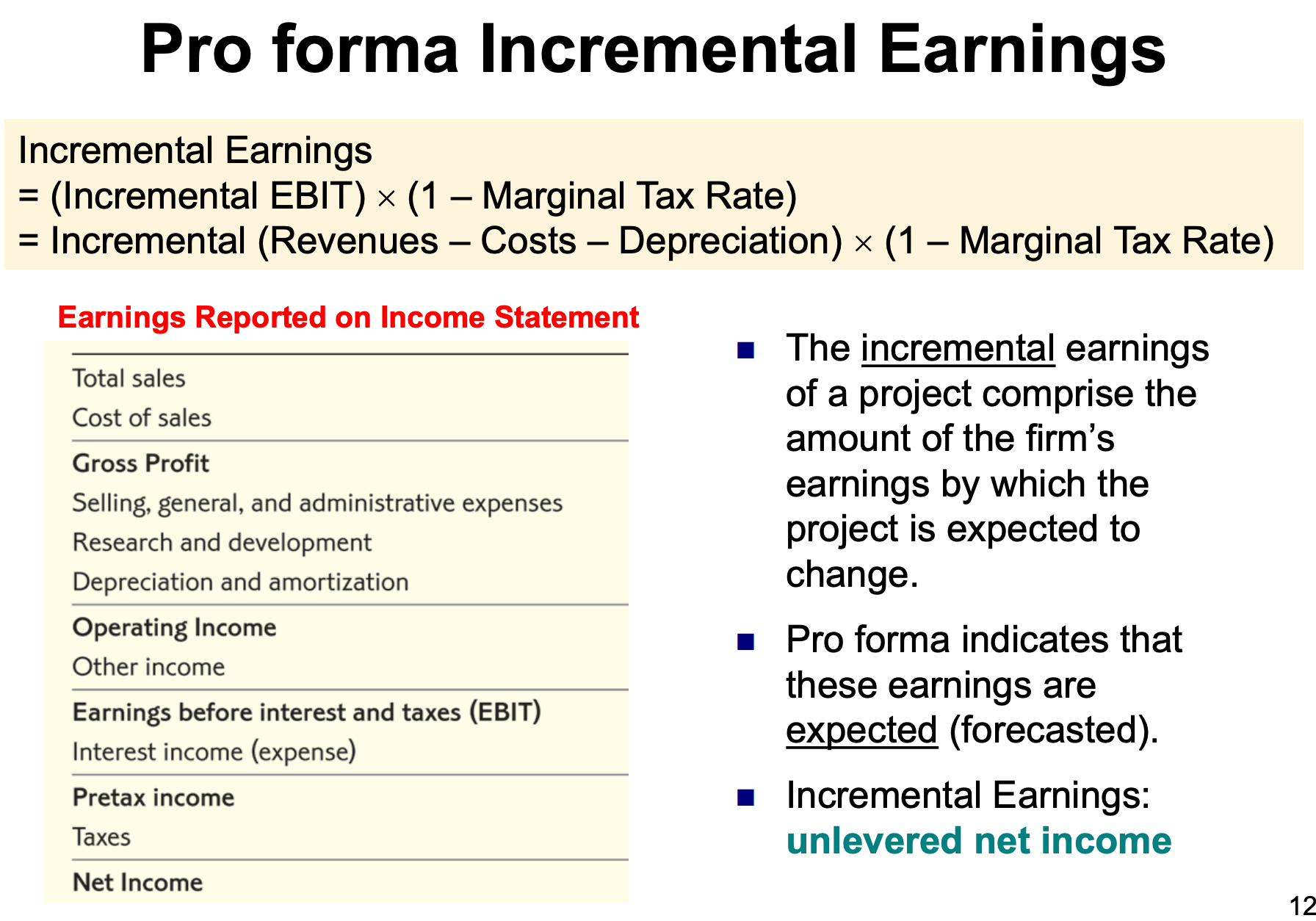

The incremental earnings of a project comprise the amount of the firm’s earnings by which the project is expected to change. Pro forma indicates that these earnings are expected (forecasted).

In order to forecast incremental earnings, we need to estimate:

- Incremental revenues

- Incremental costs

- Taxes

In general, incremental earnings are determined by:

Incremental earnings are also called unlevered net income; unlike when we normally calculate net income, after calculating EBIT, we do not subtract interest. This is because interest belongs to the bond holders, so we want to include it as part of the free cash flow.

Forecasting Considerations

Incremental Revenue and Cost Estimates

- How will the project change the earnings of the firm?

- We only want to account for additional sales and costs generated by the project.

Other factors to consider:

- New products typically have lower sales initially, sales will then accelerate, plateau, and ultimately decline.

- Average selling price of a product and its cost of production will generally change over time

- Prices and costs tend to rise with the general level of inflation in the economy

- Competition tends to reduce profit margins over time

Operating Expenses vs. Capital Expenditures

- OPEX is deducted from earnings in the year that they are incurred

- Accounting and tax treatment of CAPEX:

- Upfront cash outflows for purchase and set-up of equipment (treated as capital expenditures) are not recognized as an expense when calculating earnings for the first year. CAPEX does not show up on the income statement!

- A fraction of the capital expenditures is recorded as depreciation expenses on the income statement until its useful life according to accounting rules.

- Remember that depreciation expenses are not actual cash outflows.

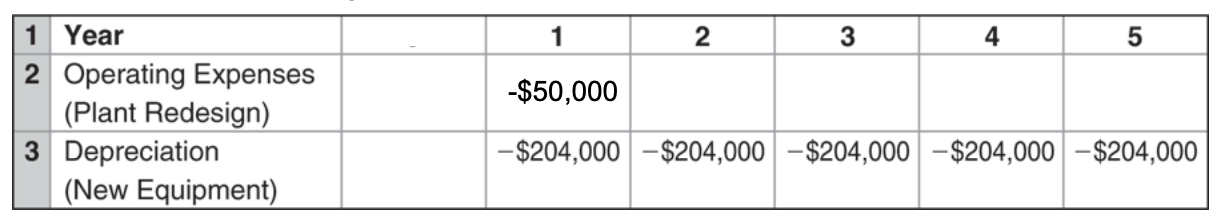

OPEX vs CAPEX Example

Suppose you are considering whether to upgrade your manufacturing plant to increase its capacity by purchasing a new piece of equipment. The equipment has a depreciable life of 5 years, costs 20,000 to transport it and install it. You will also spend $50,000 on engineering costs to redesign the plant to accommodate the increased capacity.

The pro forma income statement would look like this:

The income statement not record the capital expenditure of $1.02 million, it is depreciated over five years. The income statement never has capital expenditures!

Taxes

Incremental income taxes

- Taxes on the marginal or incremental dollar of pre-tax income.

Operating expenses and depreciation are tax deductible; they will reduce taxable earnings and result in lower taxes.

Note: If tax income is negative (a loss), then tax is negative. Negative tax is equal to a tax credit (tax refund) and will be a cash inflow.

Tax is a cash outflow.

Tax Losses for Projects Example

Kellogg Company plans to launch a new line of high-fiber, zero-trans-fat breakfast pastries. The heavy advertising expenses associated with the new product launch will generate operating losses of 320 million from operations other than the new pastries next year.

- If Kellogg pays a 40% tax rate on its pre-tax income, what will it owe in taxes next year without the new pastry product?

- What will it owe with the new pastries?

Solution: Without the new product, corporate taxes next year will be:

With the new product, corporate taxes next year will be

Launching the new product reduces taxes next year by 4 million, as if the new product had a negative tax bill of 4 million. After tax operating loss is .

Interest Expenses

Interest expenses are typically not included.

The rationale is that the project should be judged on its own operating costs and benefits, not on its financing cost.

- Separation of investment and financing decisions

- Financing costs NOT included as these are not cash flows from assets

- Debt-equity mix of the financing arrangement should be considered separately.

We thus calculate the net income assuming no debt (no leverage), and we refer to it as the unlevered net income.

Examples

Simple Example

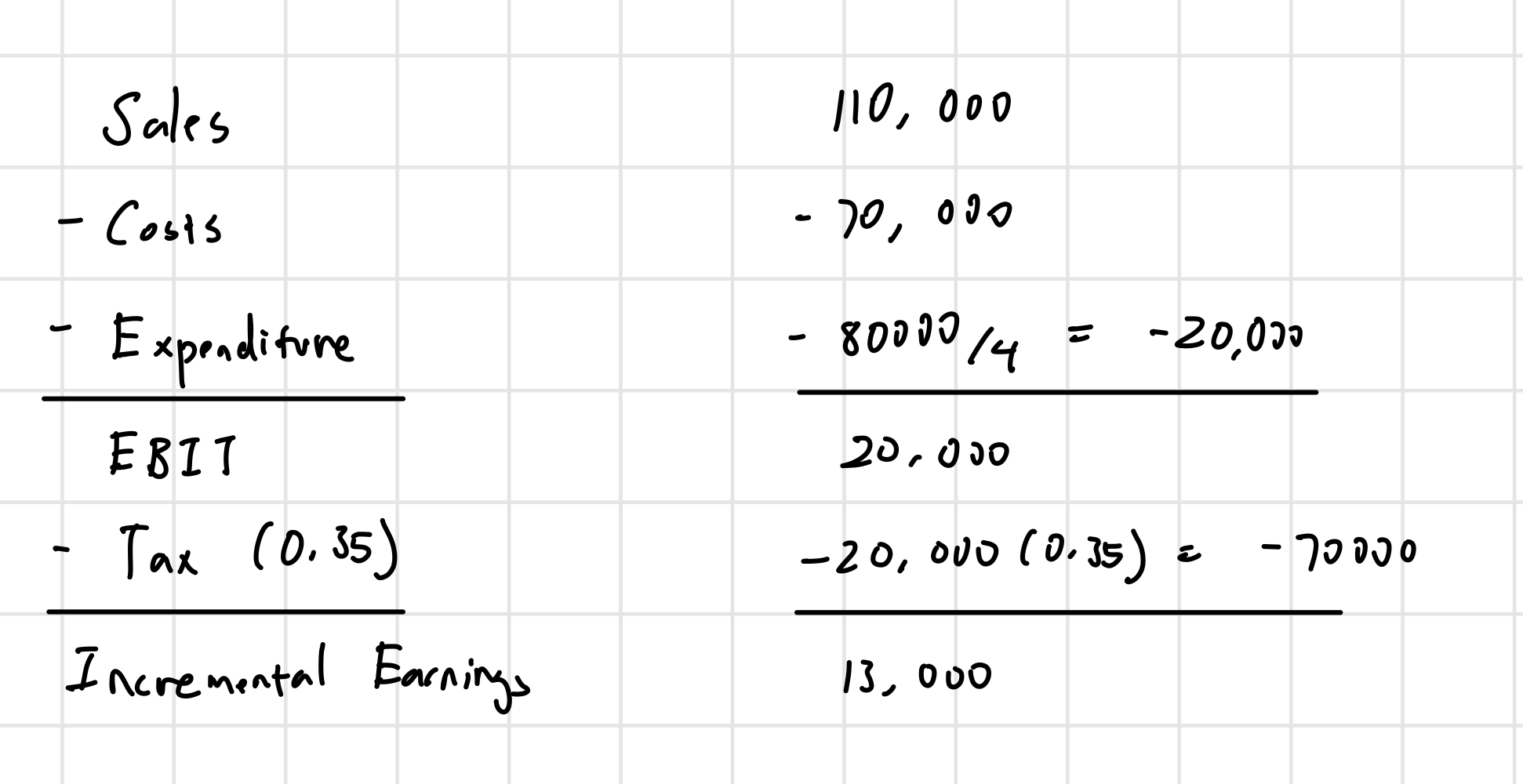

Problem: Kurt’s Kabinets is evaluating a project that will require 110,000 with associated costs of $70,000 annually. The project has a 4-year life. The company uses straight-line depreciation to a zero book value over the life of the project. The tax rate is 35%.

Solution: