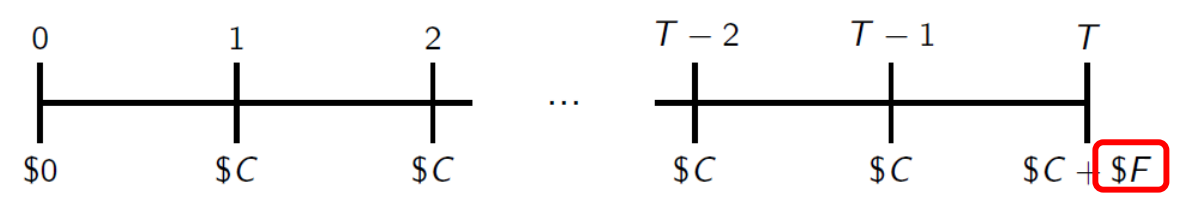

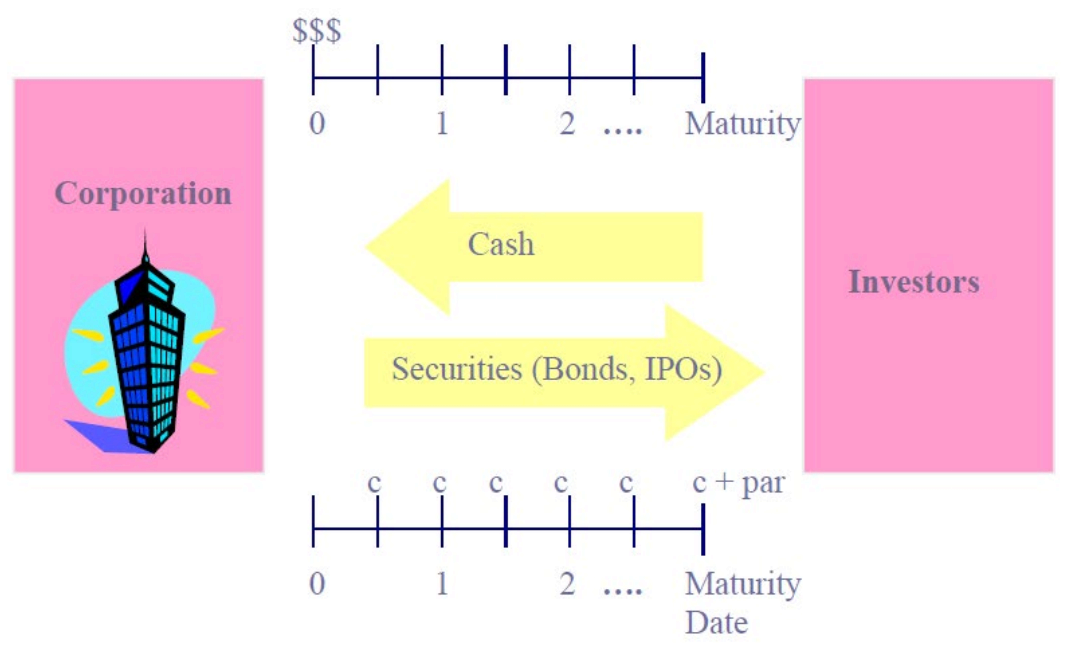

Bonds pay a fixed coupon (interest) at a fixed interval (usually every six months) and pay the par value at maturity.

Terminology:

- Bond: Fixed income securities; a debt contract promising a stream of known future cash payments to holders till the maturity date

- Bond indenture: All terms are specified in the contract: repayment type, issuer, maturity, collateral, etc.

- Maturity date: Final repayment date – payments continue until this date

- Term: The term remaining until the repayment date

- Principal or Face/Par Value: Maturity value/principal – notional amount used to compute coupon payments

- Coupon rate: A percentage of par value, expressed as an APR. This is fixed at issuance, and determines the amount of each coupon payment.

- Coupon payment: Promised interest payments, defined as

Bond Valuation

Following the valuation principle, the value of a bond is the PV of its expected future cash flows. Thus, the calculate the value of a bond, we need to:

- Identify the size and timing of cash flows

- Discount them at the correct discount rate, which depends on the default risk of the bond