- Capital budget: A list of projects and investments that a company plans to undertake during the next period

- Capital budgeting: The process of analyzing alternate investments and deciding which ones to accept. Projects we approve of will go in the capital budget.

Steps in capital budgeting:

- Estimate the project’s expected future cash flows

- Estimate the required return for projects of this risk level

- Apply capital budgeting decision rules and compute NPV or IRR

- Compute the sensitivity of the NPV to the uncertainty of the forecast (not covered in FINA 2203)

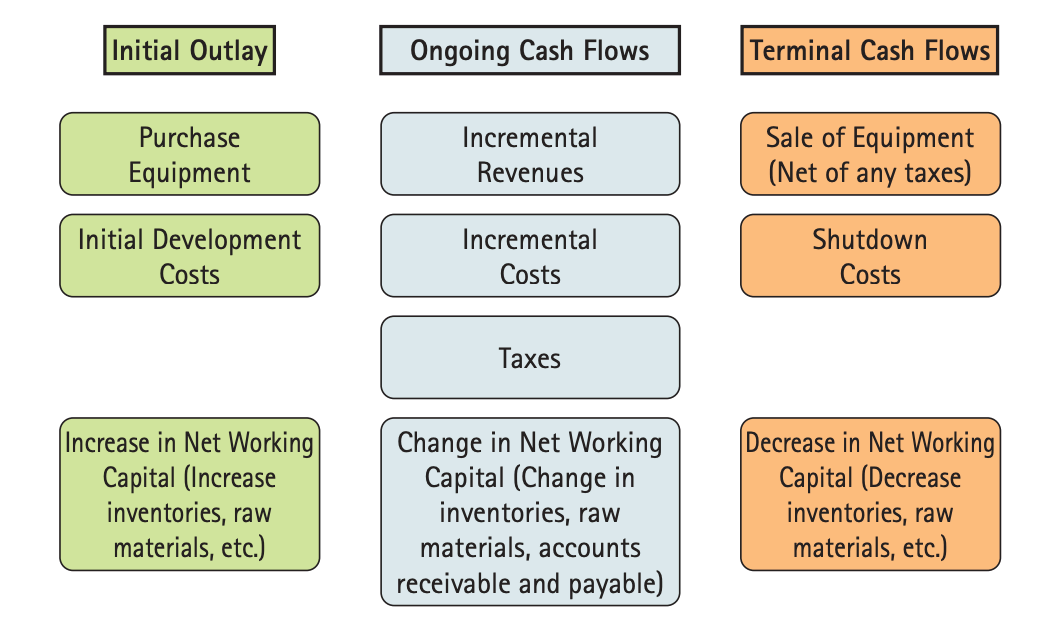

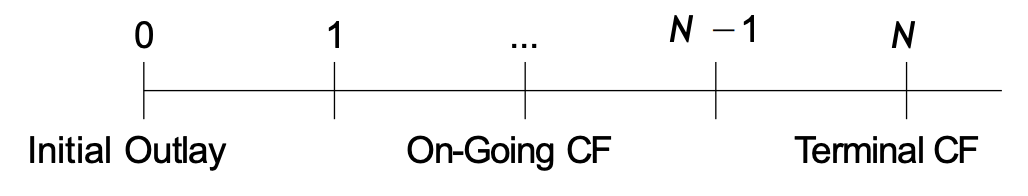

The typical cash flows in a project are shown below:

Forecasting these cash flows is challenging. We will often need to rely on different experts within the firm to obtain estimates for many of them.