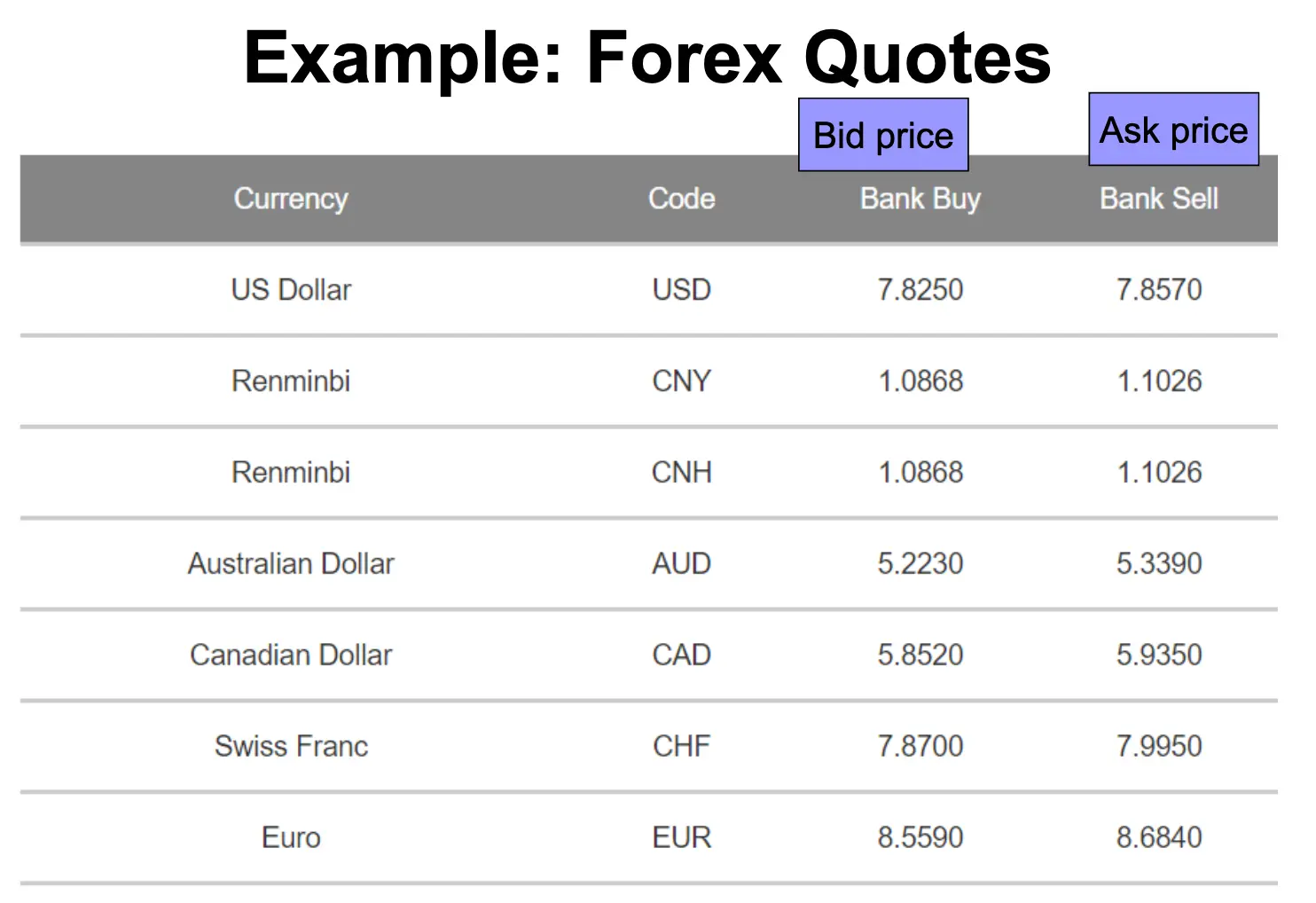

Bid-Ask Spread

- Bid-price: The price a market maker or dealer is willing to buy

- Investor’s sale price

- Ask-price: The price a market maker or dealer is willing to sell

- Investor’s purchase price

Commission

- A service charge assessed by a broker for handling the purchase or sale of a security

law of one price market question – why is “if the goods are trading in the same market” not true

Investors always buy at the ask and sell at the bid. Since ask prices always exceed bid prices, investors lose this difference. It is one of the transaction costs. Since the market makers take the other side of the trade, they make this difference.

roslaunch turtlebot_bringup turtlebot_robot.launch