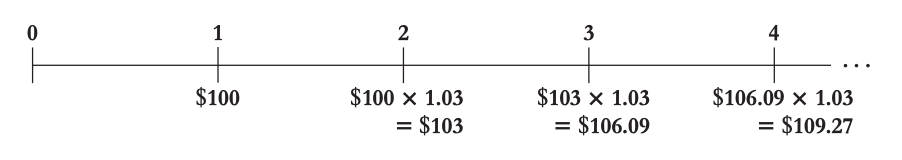

A growing perpetuity is a stream of cash flows that occur at regular intervals and grow at a constant rate forever.

We can find the present value by computing the amount you would need to deposit today to create the perpetuity yourself.

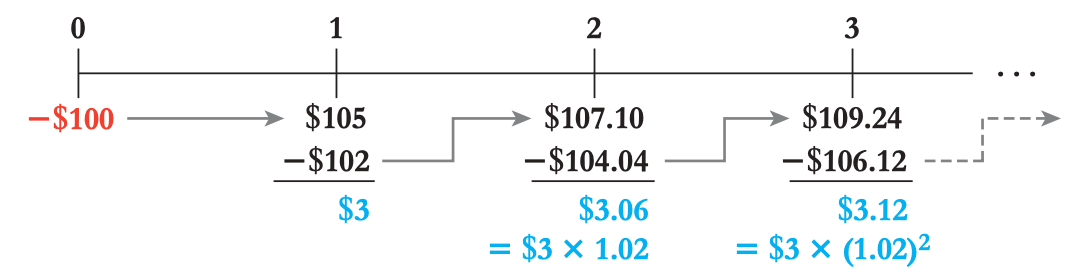

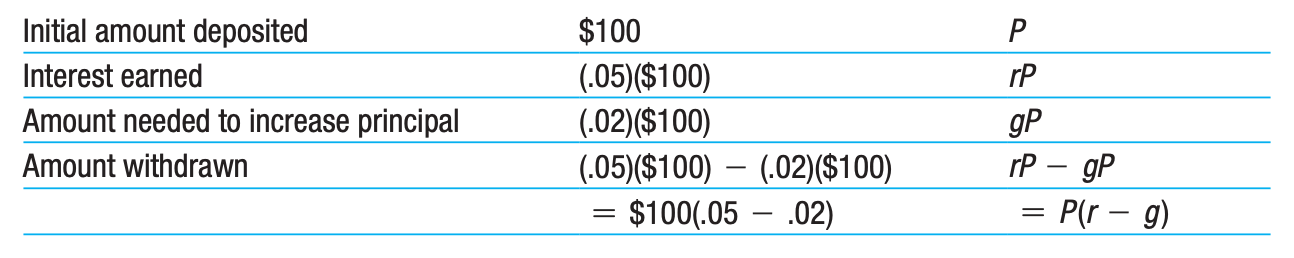

Suppose we want to create a perpetuity growing at 2%, so you invest $100 in a bank account that pays 5% interest.

- At the end of the year, you will have 100 plus $5 in interest.

- If you withdraw only 102 to reinvest – 2% more than the amount you had initially. This amount will then grow to \102 \times 1.05 = $107.10$3 \times 1.02 = $3.06$107.10-$3.06=$104.04$.

- Note that \102\times 1.02=$104.04$; both the amount you withdraw and the principal you reinvest grow by 2% each year.

In general, if we want to increase the amount we withdraw form the bank each year by , then the principal in the bank will have to grow by the same factor . Instead of reinvesting in the second year, we should reinvest . In order to increase our principal by , we need to leave of the interest in the account.

The principal must grow at the same rate as the payments to sustain the perpetuity.

The present value can then be found with: