We saw that stock valuation is determined in terms of the expected future dividends the firm will pay. Estimating these dividends is difficult; a commonly used approximation is to assume that in the long run, dividends will grow at a constant rate .

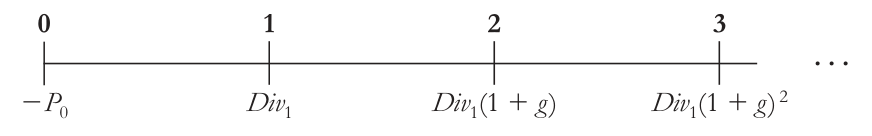

This leads to the following timeline:

Because the expected dividends are a growing perpetuity, we can calculate their value as

Example Problem

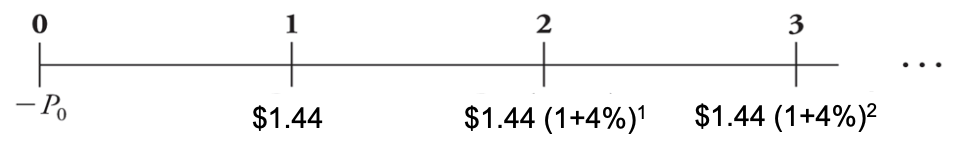

AT&T plans to pay $1.44 per share in dividends in the coming year. Its equity cost of capital is 8%. Dividends are expected to grow by 4% per year in the future. Estimate the value of AT&T’s stock.

Timeline:

We have:

Thus, we would pay 25 times this year’s dividend of 1.44 to own AT&T stocks because we are buying claim to this year’s dividend and to an infinite growing series of future dividends.

Note that:

- If the question says the company paid a dividend of X dollars last year, this is .

- If the question says the company will pay a dividend X dollars this year, this will be .

- If the question says “the company expects the learnings this year to be X dollars and the payout to be Y%”, then they will be , and we can assume this year is “at the end of this year”.