Cost of capital is the rate of return that a company must earn on its investments in order to maintain its market value and attract funds. It represents the opportunity cost of using funds for a particular investment, as opposed to deploying them in alternative investments with equivalent risk.

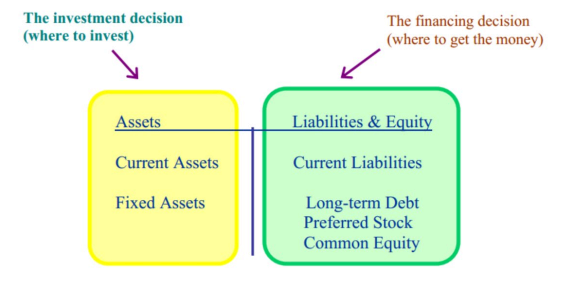

A firm’s sources of financing, which usually consist of debt and equity, represent its capital. The typical firm raises funds to invest by selling shares to stockholders (its equity) and borrowing from lenders (its debt). Recall the most basic form of the balance sheet; the left side of the balance sheet lists the firm’s assets, and the right side describes the firm’s capital.

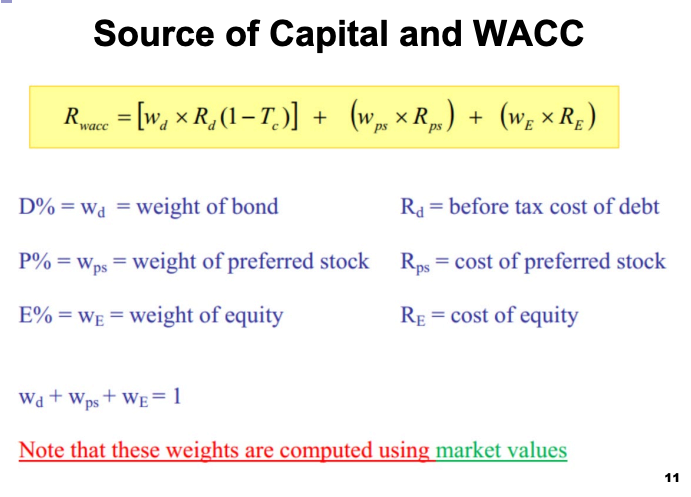

To create value, manager should invest in assets that yield higher returns than cost of funds (weighted average cost of bond, preferred stock, and common stock)

WACC Illustration

A firm is established by obtaining half of its $10 million of capital in the form of long term debt from lenders who demand an 8% yield, and half of the capital in the form of common stocks from equity holders who require a 12% rate of return.

- There is no corporate tax.

- Suppose this firm invests 50,000 to infinity, i.e., a 10% return.

- The first call on that cash flow is from the debt holders. They require 30,000 for equity holders, providing an annual return of 12%.

- Overall return of

- Thus if the project can generate a 10% return, it can meet all investors’ requirements who supplied the capital

WACC is the expected rate of return investors would demand on a portfolio of all the firm’s outstanding securities. A firm’s overall cost of capital (WACC) reflects:

- The required return of both stockholders and bondholders of the firm

- The return on its average-risk investments

- The required return on the firm’s assets as a whole, based on the market’s perception of the risk of those assets

WACC is the cost of raising additional money in the same proportion of the current mix of debt and equity in the firm.

Computing WACC

The expected return on Target’s equity is 11.5%, and the firm has a yield to maturity on its debt of 6%. Debt accounts for 18% and equity for 82% of Target’s total market value. If its tax rate is 35%, what is this firm’s WACC?

- Target needs to earn at least a 10.1% return on its investment in current and new stores to satisfy both its debt and equity holders.

- Projects with IRR lower than 10.1% should not be accepted. These projects will have negative NPV.