In order to examine the risk of an investment, we measure its variability in a distribution.

Variance and Standard Deviation:

- Measure the spread in returns

- Measure how far actual returns deviate from the mean

- Measure the volatility of asset returns

Variance estimate using realized returns:

Standard deviation is the square root of variance

- Expressed in percentage

- The larger the number, the greater the uncertainty of returns

Example

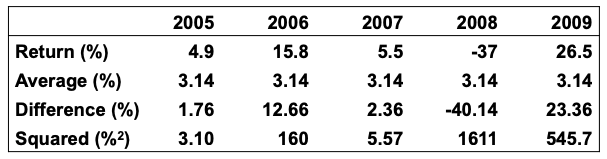

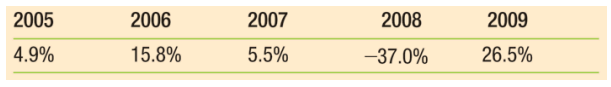

Using the following data, what is the standard deviation of the S&P 500’s returns for the year’s 2005-2009?

We have: