The dividend-discount model has some key flaws:

- A tremendous amount of uncertainty associated with forecasting a firm’s dividend growth rate and future dividends, which depends on future earnings, payout ratio and future share count.

- Small changes in the assumed dividend growth rate can lead to large changes in the estimated stock price.

- Other aspects of cash flow at management’s discretion

- Repurchase decision - Cash can be received by shareholders in the form of share repurchase instead of dividends.

- Borrowing decision - Earnings depends on interest expenses

Total Payout Model

In recent years, firms have been replacing dividend payouts with share purchases; in this case, the firm uses excess cash to buy back its own stock. Thus, total cash flows paid to shareholders should include both dividends and share repurchases.

- The larger the portion of cash payout that the firm uses to repurchase shares, the smaller the portion to pay dividends, but shareholders’ wealth is unchanged.

- By repurchasing shares, the firm decreases its share count, which increases its earnings and dividends on a per-share basis. Valuation of share price based on dividend per share, and EPS, etc will need to be adjusted.

- We can’t use the dividend-discount model to value these stocks, and use the Total Payout Model instead.

The Total Payout Model gives:

- The equity value is the PV of future total dividends and repurchases

Total Payout vs. Dividend-Discount

The Total Payout Model:

- Values all of the firm’s equity, rather than a single share.

- Discounts total amount of dividends and share repurchases, rather than earnings per share or dividends per share.

- Uses the growth rate of earnings to forecast the growth of the firm’s total payouts, rather than growth rate of dividends.

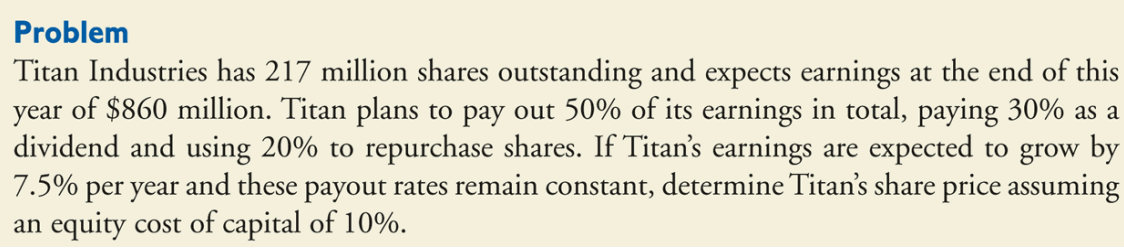

Examples

We first compute the PV of future payouts as a growing perpetuity:

The PV of payouts is equal to the total value of equity and market capitalization. Thus, we have:

Notes:

- Using the total payout method, we did not need to know the firm’s split between dividends and share repurchases.

- Cannot use Dividend Discount Model to value these stocks as number of shares will decrease after share repurchase so per share dividend amount is not applicable anymore.