Stock prices fluctuate due to two types of news:

- Market-wide news: News that affect all stocks, such as news about the economy

- Company or Industry-specific news

Fluctuations due to market-wide news are systematic risk, fluctuations due to specific news is unsystematic risk.

Systematic risk:

- Market risk

- Common risk

- Non-diversifiable risk

Unsystematic risk:

- Firm-specific risk

- Independent risk

- Diversifiable risk

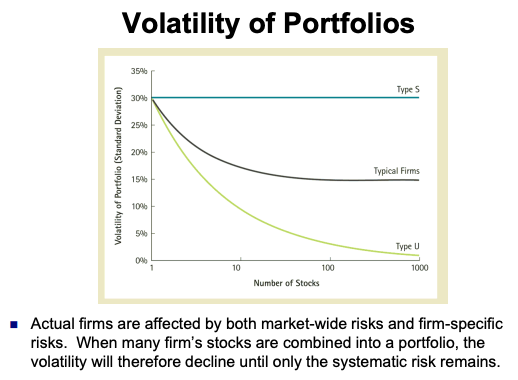

When many stocks are combined in a large portfolio, the unsystematic risk (firm-specific risks) of each stock will average out and be diversified. The systematic risk, however, will affect all firms and will not be diversified.