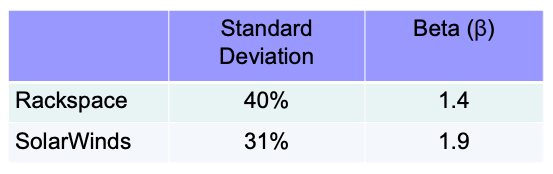

Standard deviation measures the total risk of an individual security:

The expected return of a stock is given by the risk free rate plus the risk premium; recall that the risk premium is based on only systematic risk.

The stock with a higher beta gives us more risk premium.

No matter how much total risk an asset has, only the systematic portion is relevant in determining the expected return (and risk premium) of that asset.

Which one should we pick if they have the same expected return?

- Rackspace has a lower beta (1.4 vs. 1.9) and a higher standard deviation (40% vs. 31%). This means it’s less sensitive to market movements (systematic risk). Standard deviation measures total volatility, including firm-specific risk; some of this can be diversified away.

Because the expected return is the same, a rational investor would prefer the stock with lower market risk (Rackspace in this case).