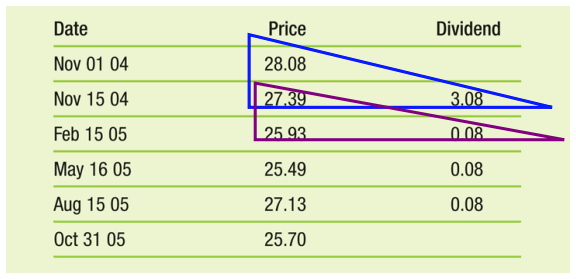

Example: Stock price and dividend data of Microsoft stock

Question

- Suppose you purchased MSFT on Nov 1, 2004 and sold it immediately on Nov 15 after receiving the divided. What was your realized return?

Realized return (non-annual holding period) is the total return that actually occurs over a particular time period (no interim cash flows):

Dividend yield is given as

Capital gain yield is given as

Question

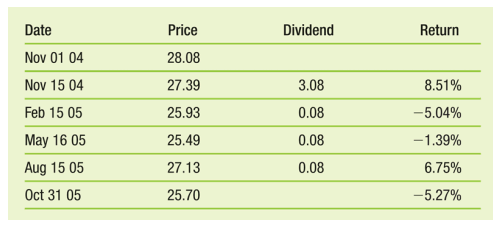

- Suppose you purchased Microsoft stock (MSFT) on Nov 1, 2004 and held it for one year, selling on Oct 31, 2005. What was your annual realized return?

- If you hold the stock beyond the date of the first dividend, then to compute your return, you must specify how you invest any dividends you receive in the interim.

- Let’s assume all dividends are immediately reinvested and used to purchase additional shares of the same stock or security.

If a stock pays dividends at the end of each quarter, with realized returns each quarter, then its annualized return, is computed as the compounded period returns:

In the case of MSFT:

Notes:

- Selling price is lower than purchase price, but the return is positive because of dividends. Total return is 2.75% over the year.

- MSFT stock price fluctuated up and down over the year. Returns are risky. Realized return is not possible to be predicted.

- However, from the observed realized returns over many years, we can graph the distribution of actual returns and calculate a historical average return which can be used as an “expected” return.