When we combine stocks in a portfolio, some of their risk is eliminated through diversification. The amount of risk that will remain depends upon the degree to which the stocks share common risk. The volatility of a portfolio is the total risk measured as standard deviation of the portfolio.

Example

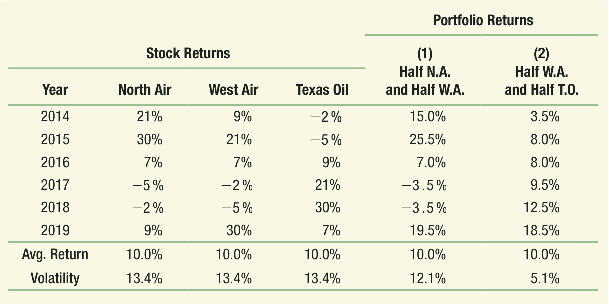

Consider the example below. While the 3 stocks have the same volatility and average return, the pattern of return differs. When the airline stocks performed well, the oil stock did poorly, and vice versa.

The right half of the table shows the returns for two portfolios of the stock. The 10% average return for both portfolios is equal to the 10% average return of the stocks; however, their volatilities are very different from.

This illustrates two important things we learned:

- By combining stocks into a portfolio, we reduce risk through diversification. Because the stocks do not move identically, some of the risk is averaged out in a portfolio. Thus, both portfolios have lower risk than individual stocks.

- The amount of risk that is eliminated in a portfolio depends upon the degree to which the stocks face common risks and move together. Because the two airline stocks tend to perform well or poorly at the same time, the portfolio of airline stocks has a volatility that is only slightly lower than the volatility of the individual stocks.